Erik Norland, CME Group

At a Glance:

- The S&P 500 has outperformed the Russell 2000 since March 2021.

- Small-cap stocks’ tendency to outperform during recessions and early-stage expansions may be related to interest rate sensitivity.

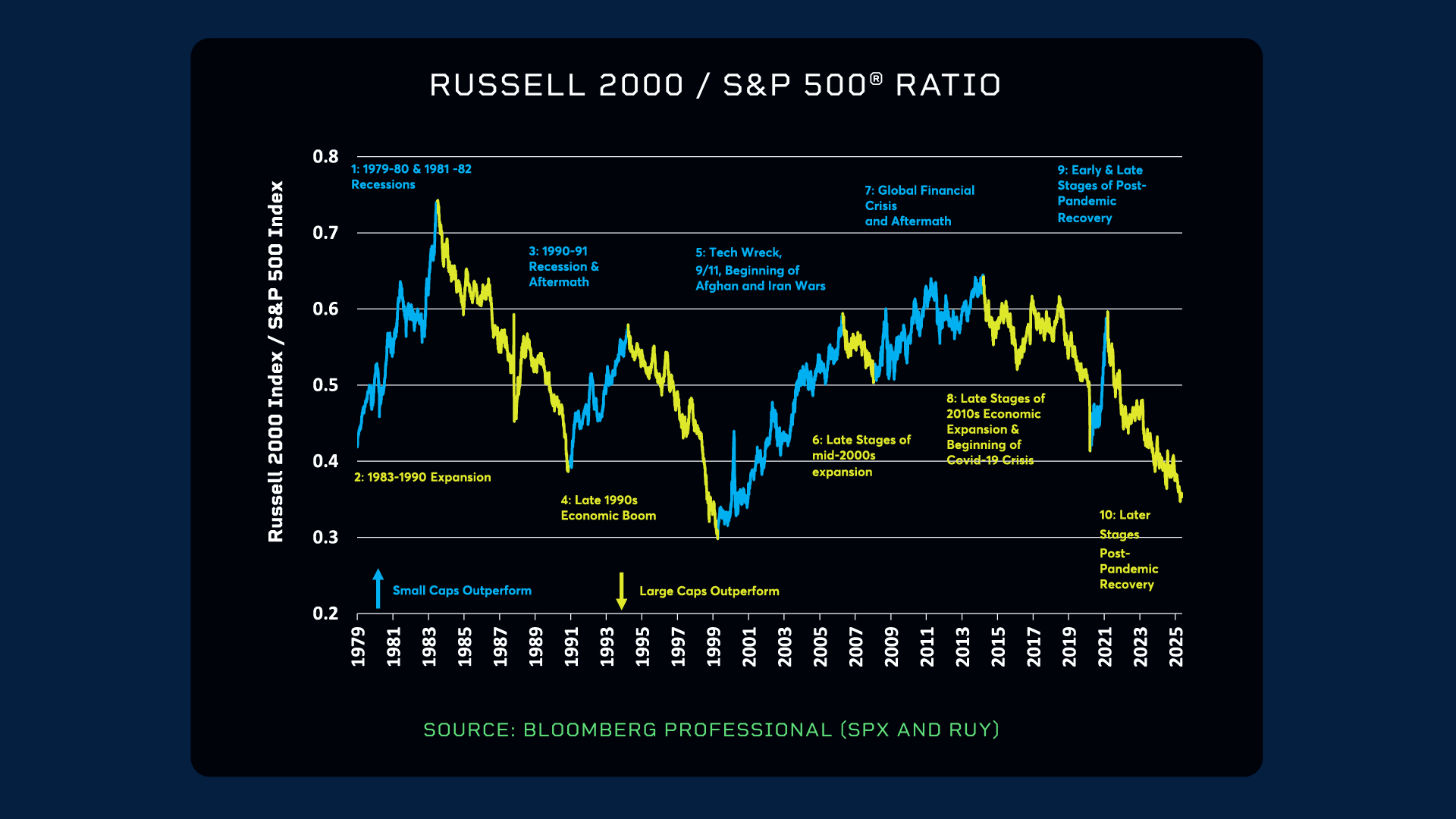

Over the past three and a half years, the S&P 500 has outperformed the Russell 2000 by approximately 70%. This raises two critical, related questions: Can this large-cap outperformance continue, and are small-cap stocks undervalued and poised for a rebound? Historically, both large-cap and small-cap stocks have generated similar returns over extended periods, but their performance cycles differ markedly.

Economic Cycles

The relationship between the Russell 2000 and the S&P 500, while generally highly correlated, has shown significant historical fluctuations that often reflect the broader economic environment.

- Late Phases of Economic Recoveries: Large-cap stocks, as represented by the S&P 500, have historically outperformed during the later stages of economic recoveries. This trend was evident in the late 1980s, the late 1990s, and from 2013 until the 2020 pandemic.

- Onset of Economic Expansions and Recessions: Small-cap stocks, as measured by the Russell 2000, tend to perform better at the beginning of economic expansions and during recessions. If the economy were to enter a downturn, the Russell 2000 could potentially become a significant outperformer.

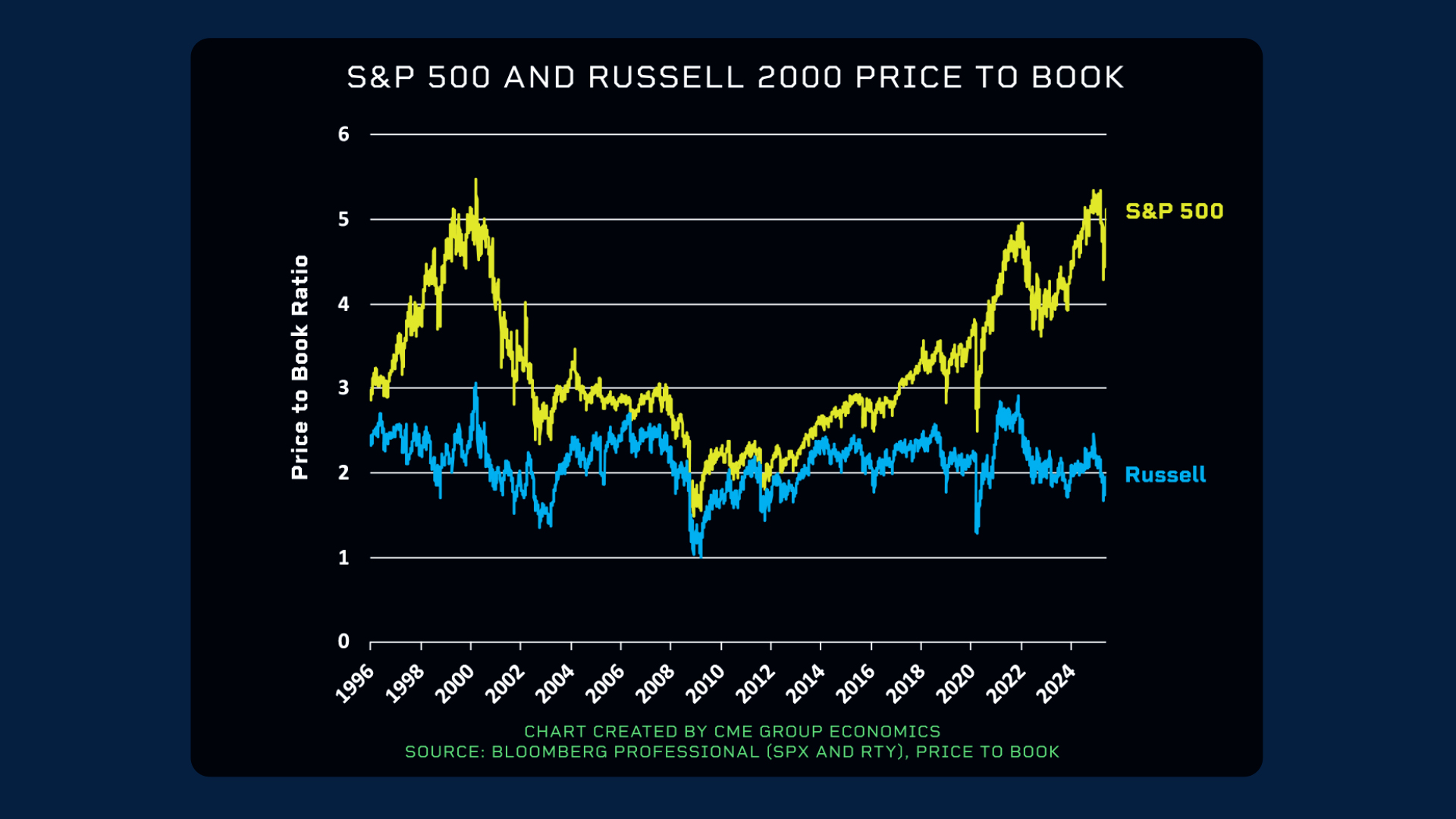

Differences in Valuation Ratios

One of the key reasons to consider a potential shift in market leadership is the substantial variance in valuation ratios between large-cap and small-cap stocks. Currently, the S&P 500 is exhibiting a price-to-sales (P/S) ratio of 3x, while the Russell 2000 is at 1x sales. In terms of book value, the S&P 500 is trading at five times book value, compared to only two times for the Russell 2000. These valuation discrepancies suggest that small-cap stocks are currently undervalued.

Given these valuation metrics and historical performance patterns, the question remains: Will small-cap stocks begin to outperform? The data point to potential outperformance, especially if economic conditions shift.

CME Group futures are not suitable for all investors and involve the risk of loss. Full disclaimer.

Copyright © 2025 CME Group Inc.