Key points:

- Colorado State University's forecast for the 2025 Atlantic hurricane season predicts "above average" activity, with 17 named storms, including nine hurricanes, highlighting a peak risk period for insurance-linked securities (ILS) investments in regions along the Gulf and East Coasts.

- Despite forecasts indicating an active hurricane season, actual financial impacts depend more on where storms make landfall rather than the total number of storms.

- The ILS market remains robust in 2025, with strong issuance levels and balanced supply and demand, although severe losses from other natural disasters, like the recent Los Angeles wildfires, highlight the complexities and risks within the broader catastrophe bond market.

- Click here to read the full article.

It is the time of year when attention, particularly in states along the Gulf and East Coasts of the US, and within the insurance sectors, turns to what we might see during the coming hurricane season in the Atlantic Basin. Colorado State University (CSU) issued its first forecast for the 2025 season earlier this month, in which it predicted “above average” activity that was widely reported on in the media, albeit under less dramatic headlines than in 2024.

The Atlantic hurricane season, which is considered to last from June to November, is a key period because that is when landfalling hurricanes are most likely to occur. It is also when investments that are exposed to these weather-related events face their peak time of being “on-risk” and associated risk premia are earned.

Crucially, many of the states and counties in affected regions of the US, and some impacted areas in the Caribbean, are densely populated and very economically active. The combination of potentially extreme natural hazard and high economic values can lead to devastating financial outcomes for private individuals and commercial enterprises.

This is why it is such an important time of the year for insurers and investors in insurance-linked securities (ILS). ILS provide protection for entities such as insurers and reinsurers against the risks associated with catastrophic natural events, such as hurricanes, and, in doing so, they also represent a source of long-term returns for investors.

Early-season forecasts therefore have the potential to cause these interested parties to adjust their risk appetite ahead of the start of the season. However, and as we will cover in more detail below, this can be pre-emptive given the challenges with early forecasts and the variable correlation between number of storms and financial losses.

What the 2025 forecast says – and what this means

CSU’s models are based on a number of statistical and meteorological models, focusing on variables such as Atlantic sea surface temperatures, sea level pressures, vertical wind shear levels (changes in wind speed or direction), and the El Niño Southern Oscillation (a recurring climate phenomenon that influences wind patterns in the tropical Atlantic).

For 2025, the early forecast – which is subject to change in future revisions and includes a high degree of uncertainty – is for an above average season in terms of hurricane activity, albeit closer to the long-term average than the early forecasts for last year. This is primarily due to warmer Atlantic sea temperatures and the current forecast for a ‘neutral’ El Niño, and so an absence of the associated upper-level westerly winds in the tropical Atlantic that are disruptive to hurricane formation, during the peak of the season.

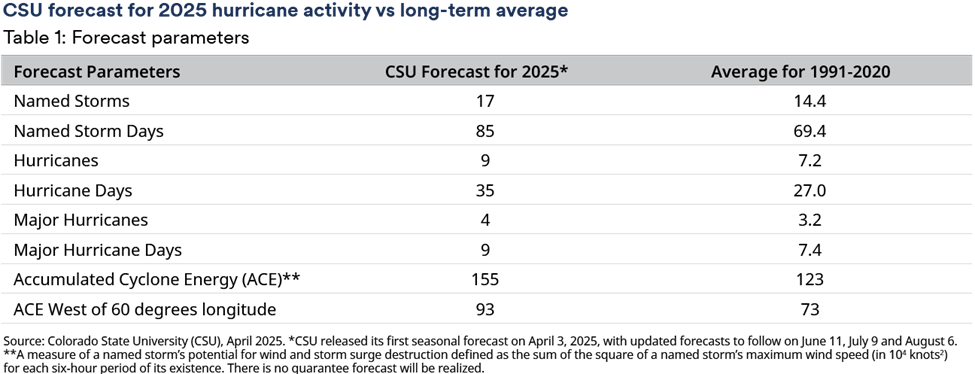

Specifically, the CSU forecast is for 17 named storms to occur this year, of which nine would be hurricanes and four classified as “major” (category 3, 4 or 5). The report additionally includes probabilities of a hurricane making landfall, which is 26% for the US East Coast, including the Florida Peninsula, and 56% for the Caribbean.

A summary of the current CSU predictions is included in the table below:

It is important to note in relation to these figures that a hurricane season with a high number of storm formations does not in and of itself drive the severity of the financial impact we will see from the season. This is determined more by the combination of an actual landfall (or multiple landfalls) in one of those densely populated areas mentioned earlier, for which the consequences can be severe.

In this context it is instructive to look back at what we saw during 2024, which was predicted to be a much more active season than the average, and indeed than 2025, and will be remembered for the devastation wrought by Hurricanes Helene and Milton. However, thanks largely to a lull in storm activity in the middle of the season, and the landfalling locations of those named storms, the overall scale and impact of the hurricane season was less than had been feared.

From an insurance perspective, the losses associated with these hurricanes were similarly far less severe than what had been estimated. In fact, in 2024 losses attributable to hurricanes ($30-50 billion) were less than the combined losses ($50 billion+) associated with so-called “secondary perils”, such as tornadoes, hailstorms, wildfires and floods. These perils are generally not expected to result in very large losses from individual events, although there are exceptions such as the Los Angeles wildfires of January 2025 (see more on this below).

Given the uncertainty of early-season forecasts, as alluded to above we recommend investors not to take investment decisions either to increase or decrease exposure to ILS purely based on these models. From our analysis of historical forecasting, we have found they do not accurately reflect the impacts, risk premium or returns that will occur during the season, which is the most important part of the year for the catastrophe (cat) bond market.

ILS market trends

The ILS market is performing well so far in 2025. The European winter season passed without any severe windstorms, while in the cat bond market the primary issuance pipeline has been very strong, with a close to record amount of issuance in Q1 and continued heavy issuance into Q2 (see above).

On the downside, the Los Angeles wildfires in January caused insured losses estimated between $30 and $40 billion, some of which made their way to the ILS market. The impact was modest but notable in the wider cat bond market, with the Swiss Re Global Cat Bond TR Index showing -0.85% performance in January.

In the private ILS market some strategies with higher-risk profiles, and those exposed to frequency rather than severity of risk (such as reinsurance sidecars that share proportionally in sponsors’ portfolios), have reportedly been severely impacted. So far there has been little reported in the public domain, but we expect this to materialize at some point.

More broadly, spread multiples reduced during 2024 and leading into 2025, as fresh capital was attracted to the ILS market. This resulted in a more balanced market from a supply and demand perspective. The strong pipeline of primary issuance, and the impact of the Los Angeles wildfires, caused the rate of reduction in spread multiples to reduce.

The market has shown pricing discipline in recent weeks and spread multiples have settled at a level which is, while lower than the record levels of the last two years, still attractive compared to long-term levels.

For more insights on ILS from Schroders Capital, please click here.

Important information

Marketing material for qualified investors only. All investments involve risk, including loss of principal.

The views and opinions contained herein are those of Schroders Capital and may not necessarily represent views expressed or reflected in other Schroders communications, strategies or funds. Such opinions are subject to change without notice. The material is not intended as an offer or solicitation for the purchase or sale of any financial instrument. The material is not intended to provide, and should not be relied on for, accounting, legal or tax advice, or investment recommendations. Any reference to regions/ countries/ sectors/ stocks/ securities is for illustrative purposes only and not a recommendation to buy or sell any financial instruments or adopt a specific investment strategy. Schroders Capital has expressed its own views and opinions in this document and these may change.

This information is a marketing communication.

Information herein is believed to be reliable but Schroders Capital does not warrant its completeness or accuracy. The data contained in this document has been sourced by Schroders Capital and should be independently verified. Third party data is owned or licenced by the data provider and may not be reproduced, extracted or used for any other purpose without the data provider’s consent. Neither Schroders Capital, nor the data provider, will have any liability in connection with the third-party data.

The forecasts stated in the document are the result of statistical modelling, based on a number of assumptions. Forecasts are subject to a high level of uncertainty regarding future economic and market factors that may affect actual future performance. The forecasts are provided to you for information purposes as at today’s date. Our assumptions may change materially with changes in underlying assumptions that may occur, among other things, as economic and market conditions change. We assume no obligation to provide you with updates or changes to this data as assumptions, economic and market conditions, models or other matters change.

This document may contain “forward-looking” information, such as forecasts or projections. Please note that any such information is not a guarantee of any future performance and there is no assurance that any forecast or projection will be realized.

Past performance is not a guide to future performance and may not be repeated. The value of investments and the income from them may go down as well as up and investors may not get back the amount originally invested. Diversification cannot ensure profits or protect against loss of principal.

Schroders Capital is the private markets investment division of Schroders plc. Schroders Capital Management (US) Inc. (‘Schroders Capital US’), is registered as an investment adviser with the US Securities and Exchange Commission (SEC), CRD Number 145194. Issued by Schroder Fund Advisors LLC (“SFA”), CRD Number 24129, registered as a limited purpose broker-dealer with the Financial Industry Regulatory Authority (FINRA) and as an Exempt Market Dealer with the securities regulatory authorities in Alberta, British Columbia, Manitoba, New Brunswick, Newfoundland and Labrador, Nova Scotia, Ontario, Quebec, and Saskatchewan. Schroder Fund Advisors LLC, 7 Bryant Park, New York, NY 10018-3706. For more information, visit www.schroderscapital.com