As we frequently bring together the world’s most influential decision makers within the global asset management industry, we often gain insights into some of the strategic considerations shaping the financial landscape. These insights, largely taken from our proprietary member events, encompass wide swaths of the industry, from data-driven decision-making to what investment vehicles asset product officers are prioritizing for the future.

Our event in March, the Investment Product Institute Roundtable, was no exception, bringing together some of the industry’s most influential investment product officers. During the event, attendees were polled on their growth strategies and decisions regarding key shifts in asset management product offerings.

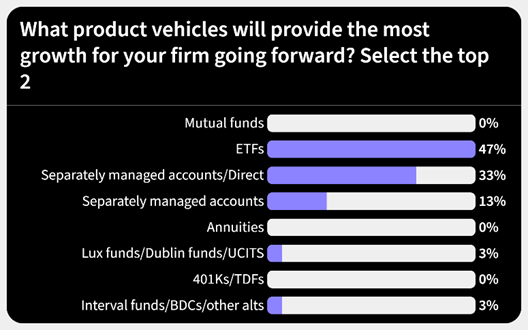

Source: Investment Product Institute

When asked which product vehicles will drive the most growth in the future, product officers favored ETFs (47%) and separately managed accounts/direct indexing (33%). Notably, traditional products like mutual funds, annuities, and 401(k)/TDFs (which historically made up a significant portion of institutional portfolios) were rated at 0%, expressing a potential move toward more flexible, customizable investment structures.

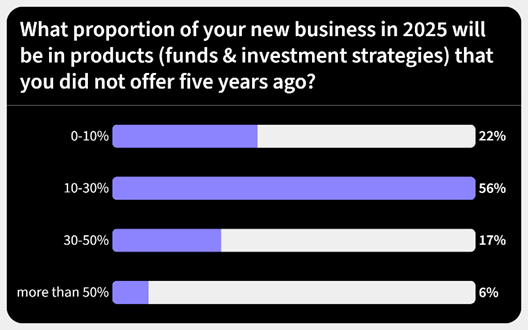

Firms are also expanding and putting their faith into new products. A majority of product officers (56%) expect that between 10% and 30% of their new business in 2025 will come from products and strategies not offered five years ago. Only 22% anticipate minimal changes (0-10%), indicating that innovation and diversification are top priorities.

The data suggests product officers are leaning toward mainstream, scalabe vehicles (ETFs, SMAs) as key drivers of growth, which may signal a notable shift in investment preferences compared to five years ago. The shift may be driven by the fact that ETFs have made investing more accessible and cost-effective for a broader range of investors than traditional products. Moreover, the ETF universe has expanded significantly in recent years, democratizing access to investment strategies that were once limited in their accessibility.

Managers have also become increasingly liquidity-conscious as markets have experienced significant periods of volatility over the past 18 months. In particular, ETFs have developed considerably to offer new pathways to both passive and active management while delivering liquidity and transparency via public exchanges. Actively managed ETFs in particular have gained popularity due to attractive features like low fees, tax efficiency, and transparency compared to traditional active mutual funds. Modern ETFs are also versatile enough to capture specific investment objectives, like alpha generation, tax optimization, or geographic theme. This has made the ETF especially attractive to a wide range of investment professionals, from advisors in model portfolios to institutional managers needing to deploy or redeploy capital at scale.

Overall, these trends suggest that investment managers are increasingly prioritizing flexible, innovative product solutions – particularly in ETFs, private assets, and SMAs – as traditional offerings lose their dominance. Considering the current challenging macro envrionment – inflation, high interest rates, and geopolitical/trade conflicts – we will be keen to observe whether these shifts in investor product preferences endure or lose their gusto in the face of wideswept market challenges.

For more insights and to connect with our Thought Leadership Department, click here.

Market Intelligence Is Independent of the Institutional Investor Magazine Newsroom