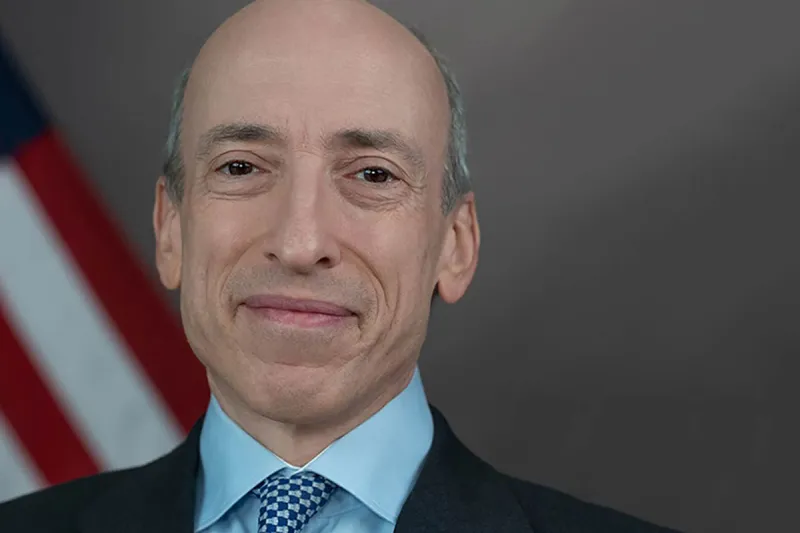

Gary Gensler: Institutions Should Be Sweating Over the New U.S. Economic Trajectory

In a sweeping interview with II, the ex-SEC chair discusses his new book and argues that the Trump administration’s policies will ultimately undermine U.S. economic dynamism.

John Crabb

June 18, 2025