In brief

- After a roaring comeback from 2020 lows, valuations look stretched, and spreads look exceedingly tight given underlying secular challenges. We feel investors should consider focusing on risk management and mitigating downside risk in investment markets, a process inherent in active management.

- Active managers have historically performed better in difficult markets (Exhibit 1), and top-quartile active managers have historically added substantial excess return in down markets (Exhibit 2).

- Even top-quartile active managers routinely underperform. Investors should consider developing a tolerance for underperformance and using a long-term performance time period to assess skill.

- Identifying the attributes of a skilled active manager may be critical to driving long-term outcomes. In our view, high active share, long holding periods, thoughtful risk management and collaborative research teams that take what we call an Active 360° perspective can validate skill.

The importance of alpha

Prior to the pandemic, many in the market were concerned about high levels of debt, poor long-term demographics and the ability to generate the real growth needed to service debt levels. Today, we believe those secular challenges have become worse. Globally, debt is higher today than before the pandemic, and birth rates have declined dramatically during it. The world will most likely continue to struggle with debt sustainability and real growth. Looking forward, we believe capital market returns will be historically low over the next 10 years, substantially trailing their 10- and 15-year historical returns.2 Finding alpha during a difficult market environment will become increasingly important for driving long-term results. The opportunity for alpha generation for active managers that invest over a complete market cycle could be powerful, especially those who view investments through multiple lenses, or take what we call an Active 360° perspective. Moreover, given the concentration of US equity indices and high valuations, we believe that investors should consider a focus on risk management and mitigating downside risk, as active managers do.Active managers deliver in tough markets

Strength in stocks and bonds over the past decade has coincided with a large shift from active to passive management. The move suggests a desire on the part of some to reduce fees; for others, the move has reflected that many active managers have trailed their benchmarks. However, looking back at the 20-year period from 2001 to 2020, active managers generally performed better in tough markets (Exhibit 1). Put another way, active managers have proven their worth on the downside. We feel that given the current environment and likelihood of more volatility, the ability to preserve capital in rough markets will be key to driving excess returns over a full market cycle.

Active skill and risk management matters

More to the point, not all active managers are created equal. As Exhibit 2 shows, from 1991 to 2020, top-quartile active managers added value above the S&P 500 Index in all market environments. In rising markets, median managers have typically had trouble keeping up with skilled managers, while top-quartile active managers have added value in up markets, and more important in our view, shone in down markets. In poor markets, active risk management has been rewarded, a process that is less robust in passive portfolios. For example, active managers select securities rather than "owning the index" and can avoid companies or industries with low-quality, unsustainable earnings. Passive does not allow the same risk assessment. In other words, what you don't own is just as important as what you do.

At MFS, rather than chasing short-term gains, we actively manage risk when the markets are inefficient and seek to add value by managing volatility and navigating changing market cycles more effectively. Because if you can lose less value in a down market, you can begin to grow it from that higher capital base. That is how you compound long-term returns and how we believe investors should be thinking about risk today.

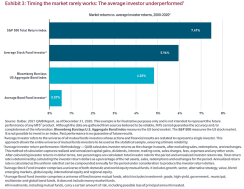

Short-termism: Why has the average investor underperformed?

It is a fact that even skilled active managers underperform at times. This can be challenging for investors. Studies by DALBAR, Inc. have shown that investors' decisions to buy, sell and switch in and out of mutual funds have consistently resulted in substantial underperformance. As illustrated in Exhibit 3 below, when investors tried to protect their portfolios by market timing, they often limited gains and increased losses instead.

We think that a misalignment of time horizons is one of the reasons why. Most skilled active managers look to generate consistent alpha over a full market cycle, which typically takes 7 to 10 years.3 However, the industry has anchored around three- and five-year performance time periods to assess skill. In reality, a three-year time period is less than half of the historical time period of a full market cycle. Apparently, while a majority of institutional investors know this, few will tolerate negative alpha on a three-year basis,4 yet when discussing objectives, few financial professionals or asset managers discuss the metrics for measuring skill and the time frame of a "full" market cycle. To us, however, it does make sense to discuss the use of longer-term-performance time periods when assessing skill.

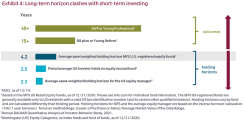

The misalignment makes even less sense when you look at the time horizon associated with most investors' reason for investing — typically saving for retirement (Exhibit 4). The average asset-weighted holding period for a US equity manager is only 2.3 years. While this does align with a 1- to 3-year performance period, it does not align with investors' long-term goals. MFS' average asset-weighted holding period for US-registered funds is almost double the industry average and thus more closely aligned with investor goals. We have high confidence in our long-term performance, where fundamentals typically prevail. We feel market sentiment, rather than fundamentals, is more likely to drive what our performance will look like over the next quarter or year.

Investors may be better served by developing a tolerance for underperformance — what we call countercyclical courage — that may potentially lead to more value creation and a better outcome over time. When markets sell off, good active managers often use weakness as a rationale for buying when they have conviction in a company and the patience to ignore market noise and wait for a potential rebound. The COVID-related downturn is a prime example and demonstrates what separates above-average active managers from median managers. MFS investment teams understand their companies, their operations and their best- and worst-case scenarios. During a downturn, our teams can quickly assess what has changed and which companies are attractive long-term buying opportunities. To take advantage of a decline, your analysis — especially scenario modeling — needs to be in place. If you wait until volatility occurs to analyze companies, you will be too late.

Identifying skilled active managers

While it may sound simple, separating skill from luck is anything but. In our recent Compass Survey, only 30% of institutional investors indicated they could tell the difference between a skilled active manager and an average one.5 We believe that skilled active managers — those who demonstrate conviction through high active share and long holding periods, manage risk thoughtfully and bring together different perspectives — can add value in all markets environments. MFS has always adhered to this philosophy and a single purpose: to create value by allocating capital responsibly for clients.Active 360° approach

Our investment process is predicated on bringing teams of equity, fixed income and quantitative analysts together to share and respectfully challenge ideas. We call this our Active 360° approach and believe that analyzing investments from all angles leads to the best investment ideas for our clients. A core tenet of this approach is believing that long-term active management is synonymous with sustainability investing; in order for a company to generate durable earnings over time, it must be sustainable from both a financial and ESG perspective. So rather than approach sustainable investing as a separate practice or product, MFS has integrated material ESG factors into our research process; it is how we analyze investments from a 360° perspective. As an active manager, we believe this drives long-term returns and is a critical part of being good stewards of capital and investing responsibly.Allocating capital responsibly also relies on a differentiated investment process and culture. At MFS, our process and culture are built on three distinct pillars: collective expertise, active risk management and long-term discipline.

Collective expertise

We believe that teams of diverse thinkers contributing different perspectives and actively debating them within a shared value system are more likely to understand and incorporate all financially material factors, enabling better investment outcomes. The goal of our investment teams is to uncover sustainable opportunities or identify pitfalls that other managers may have missed. Our investors engage directly with the companies we own to understand what could impact the sustainable value of those companies, and they exercise our voting power to influence issues that matter.Active risk management

Our risk aware culture leads us to try to understand which risks — whether fundamental, secular, macroeconomic or ESG — are material to a company's long-term sustainability (not just noise) and how those risks may evolve over time. It is thinking through the risks that you see and trying to anticipate those you don't — e.g., the coronavirus. We believe the pandemic will likely have long-lasting impacts on governments, consumers, companies and industries. In this uncertain environment, active risk management is essential in both accurately assessing risks and avoiding entities that may stumble or fail. And we cannot stress this enough: Owning the index — passive — does not allow for the same risk assessment.Risk management is also about understanding how the risks we anticipate compare with the risks our clients are taking. In other words, we leverage our risk capabilities to fully understand the risks inherent in clients' portfolios, because we recognize that for our clients, how you get there is just as important as getting there. That is why we closely monitor capacity management and close strategies to help protect the interests of clients and the management of the long-term performance of their assets.

Long-term discipline

MFS believes in long-term thinking for two reasons. First, because we think that it aligns better with our client's goals and leads to better investment outcomes. We focus on factors that create a sustainable enterprise capable of driving long-term returns rather than short-term gains, factors such as unit growth, pricing power, durable competitive advantages, free cash flow, debt levels, financial materiality and management strength, to name a few. The second reason we believe in long-term thinking is time horizon. By holding stocks for longer, we take advantage of the greater return dispersion between the best- and worst-performing stocks and the potential to improve returns for investors. The strength of our research, garnered through collective expertise, gives us the conviction and patience to let investment ideas play out over time. Compensation for investment teams reflects this: We reward our teams for long-term performance, not for chasing short-term gains.Conclusion

In our view, skilled active management is a critical component of any investment portfolio and especially relevant in the current environment. As active managers, we strive to identify companies that can sustain a competitive advantage over the long term. For us, active management is our culture, our DNA and how we create long-term value for our clients responsibly. At a time when the industry is facing pressure and consolidation, our focus is on allocating capital responsibly over the long term for the end investor, period. We operate from a position of strength — our process, our people and our clarity of purpose — as we seek the best investment ideas for the benefit of our clients. For nearly a century, we have aligned our active investment approach with the way we serve clients: bring together different perspectives, have conviction in our investment ideas and thoughtfully manage risk, all with the goal of delivering long-term, sustainable outcomes for clients. In other words, we have taken an Active 360° approach.Download a PDF of this article.

1 Source: Bernstein. Monthly data from 31 January 1881 to 28 February 2021.

2 Annualized return over the next 10 years. MFS Long-Term Capital Market Expectations, January 2021.

3 Source: "Defining a Market Cycle," Manning & Napier.

4 Source: May 2021 MFS Institutional Investor Compass (including 540 global institutional investors). (Q) How long are you willing to tolerate the underperformance of active asset managers?

5 Source: May 2021 MFS Institutional Investor Compass (including 540 global institutional investors). Source: May 2021 MFS Institutional Investor Compass (including 540 global institutional investors). Source: May 2021 MFS Institutional Investor Compass (including 540 global institutional investors).

Disclosures

Bloomberg Index Services Limited. BLOOMBERG® is a trademark and service mark of Bloomberg Finance L.P. and its affiliates (collectively "Bloomberg"). BARCLAYS® is a trademark and service mark of Barclays Bank Plc (collectively with its affiliates, "Barclays"), used under license. Bloomberg or Bloomberg's licensors, including Barclays, own all proprietary rights in the Bloomberg Barclays Indices. Neither Bloomberg nor Barclays approves or endorses this material or guarantees the accuracy or completeness of any information herein or makes any warranty, express or implied, as to the results to be obtained therefrom and, to the maximum extent allowed by law, neither shall have any liability or responsibility for injury or damages arising in connection therewith.

"Standard & Poor's®" and S&P "S&P®" are registered trademarks of Standard & Poor's Financial Services LLC ("S&P") and Dow Jones is a registered trademark of Dow Jones Trademark Holdings LLC ("Dow Jones") and have been licensed for use by S&P Dow Jones Indices LLC and sublicensed for certain purposes by MFS. The S&P 500® is a product of S&P Dow Jones Indices LLC, and has been licensed for use by MFS. MFS's Products are not sponsored, endorsed, sold or promoted by S&P Dow Jones Indices LLC, Dow Jones, S&P, or their respective affiliates, and neither S&P Dow Jones Indices LLC, Dow Jones, S&P, their respective affiliates make any representation regarding the advisability of investing in such products.

©2021 Morningstar, Inc. All Rights Reserved. The information contained herein: (1) is proprietary to Morningstar and/or its content providers; (2) may not be copied or distributed; and (3) is not warranted to be accurate, complete or timely. Neither Morningstar nor its content providers are responsible for any damages or losses arising from any use of this information.

The views expressed are those of the author(s) and are subject to change at any time. These views are for informational purposes only and should not be relied upon as a recommendation to purchase any security or as a solicitation or investment advice from the Advisor. No forecasts can be guaranteed.

Unless otherwise indicated, logos and product and service names are trademarks of MFS® and its affiliates and may be registered in certain countries.

Distributed by:

U.S. - MFS Investment Management; Latin America - MFS International Ltd.; Canada - MFS Investment Management Canada Limited. No securities commission or similar regulatory authority in Canada has reviewed this communication.

Please note that in Europe and Asia Pacific, this document is intended for distribution to investment professionals and institutional clients only.

U.K./EMEA – MFS International (U.K.) Limited (“MIL UK”), a private limited company registered in England and Wales with the company number 03062718, and authorized and regulated in the conduct of investment business by the U.K. Financial Conduct Authority. MIL UK, an indirect subsidiary of MFS, has its registered office at One Carter Lane, London, EC4V 5ER UK/MFS Investment Management (Lux) S.à r.l. (MFS Lux) – MFS Lux is a company is organized under the laws of the Grand Duchy of Luxembourg and an indirect subsidiary of MFS – both provides products and investment services to institutional investors in EMEA. This material shall not be circulated or distributed to any person other than to professional investors (as permitted by local regulations) and should not be relied upon or distributed to persons where such reliance or distribution would be contrary to local regulation; Singapore – MFS International Singapore Pte. Ltd. (CRN 201228809M); Australia/New Zealand – MFS International Australia Pty Ltd (“MFS Australia”) (ABN 68 607 579 537) holds an Australian financial services licence number 485343. MFS Australia is regulated by the Australian Securities and Investments Commission.; Hong Kong – MFS International (Hong Kong) Limited (“MIL HK”), a private limited company licensed and regulated by the Hong Kong Securities and Futures Commission (the “SFC”). MIL HK is approved to engage in dealing in securities and asset management regulated activities and may provide certain investment services to “professional investors” as defined in the Securities and Futures Ordinance (“SFO”).; For Professional Investors in China – MFS Financial Management Consulting (Shanghai) Co., Ltd. 2801-12, 28th Floor, 100 Century Avenue, Shanghai World Financial Center, Shanghai Pilot Free Trade Zone, 200120, China, a Chinese limited liability company regulated to provide financial management consulting services.; Japan – MFS Investment Management K.K., is registered as a Financial Instruments Business Operator, Kanto Local Finance Bureau (FIBO) No.312, a member of the Investment Trust Association, Japan and the Japan Investment Advisers Association. As fees to be borne by investors vary depending upon circumstances such as products, services, investment period and market conditions, the total amount nor the calculation methods cannot be disclosed in advance. All investments involve risks, including market fluctuation and investors may lose the principal amount invested. Investors should obtain and read the prospectus and/or document set forth in Article 37-3 of Financial Instruments and Exchange Act carefully before making the investments.

MFSE-WP-883451-6/21

46798.2