Erik Norland, CME Group

At a Glance:

- Over the past 15 years, the rise of digital photography has led silver to underperform gold, but new technologies like solar panels may improve silver’s outlook.

- Central bank gold purchases have been a key factor in gold outperforming silver.

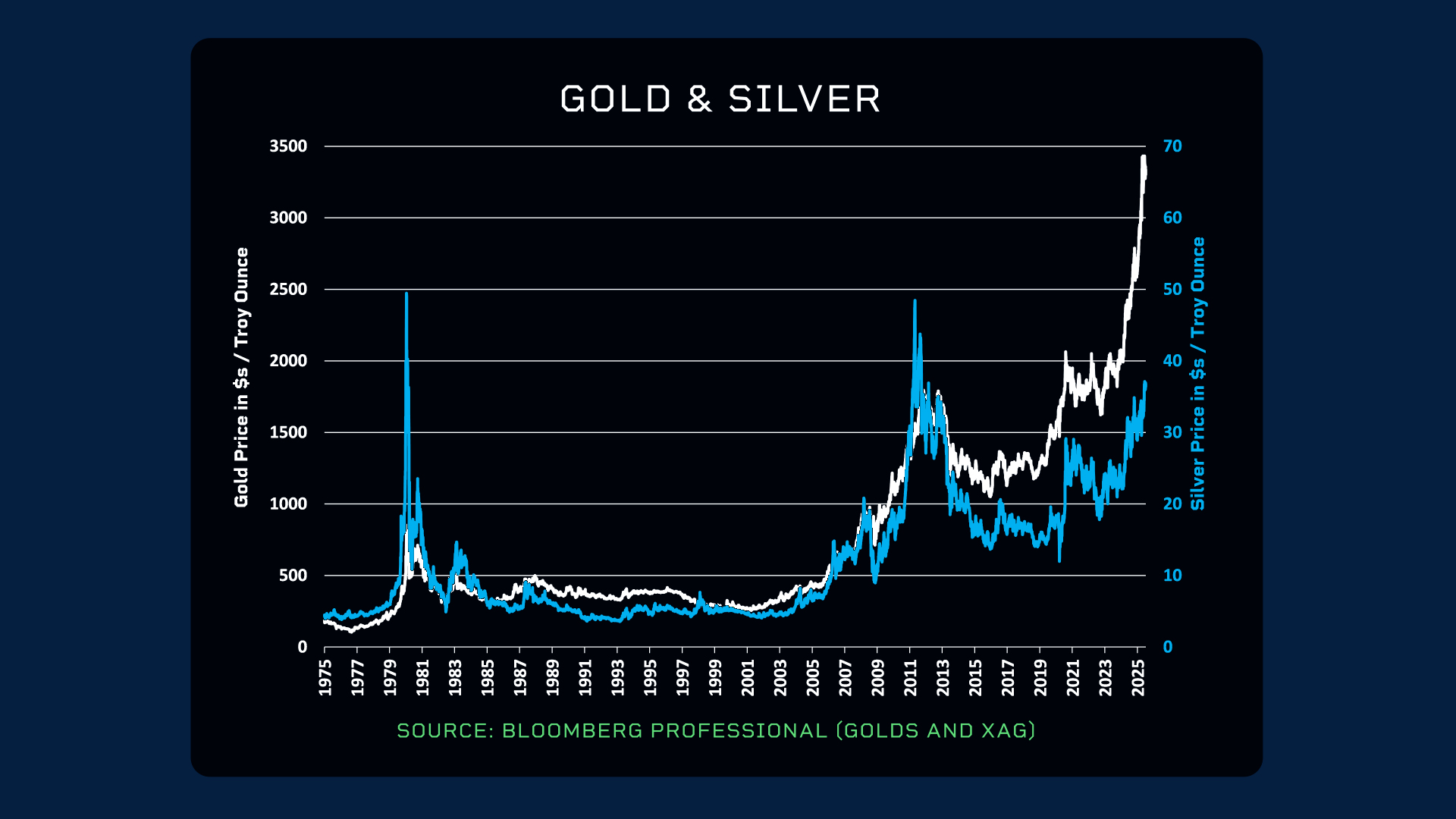

As gold hit record highs above $3,000 an ounce, a key question emerges: can lagging silver close the performance gap? Although silver prices have recently seen a notable rebound against gold, silver remains a considerable underperformer over the past 15 years.

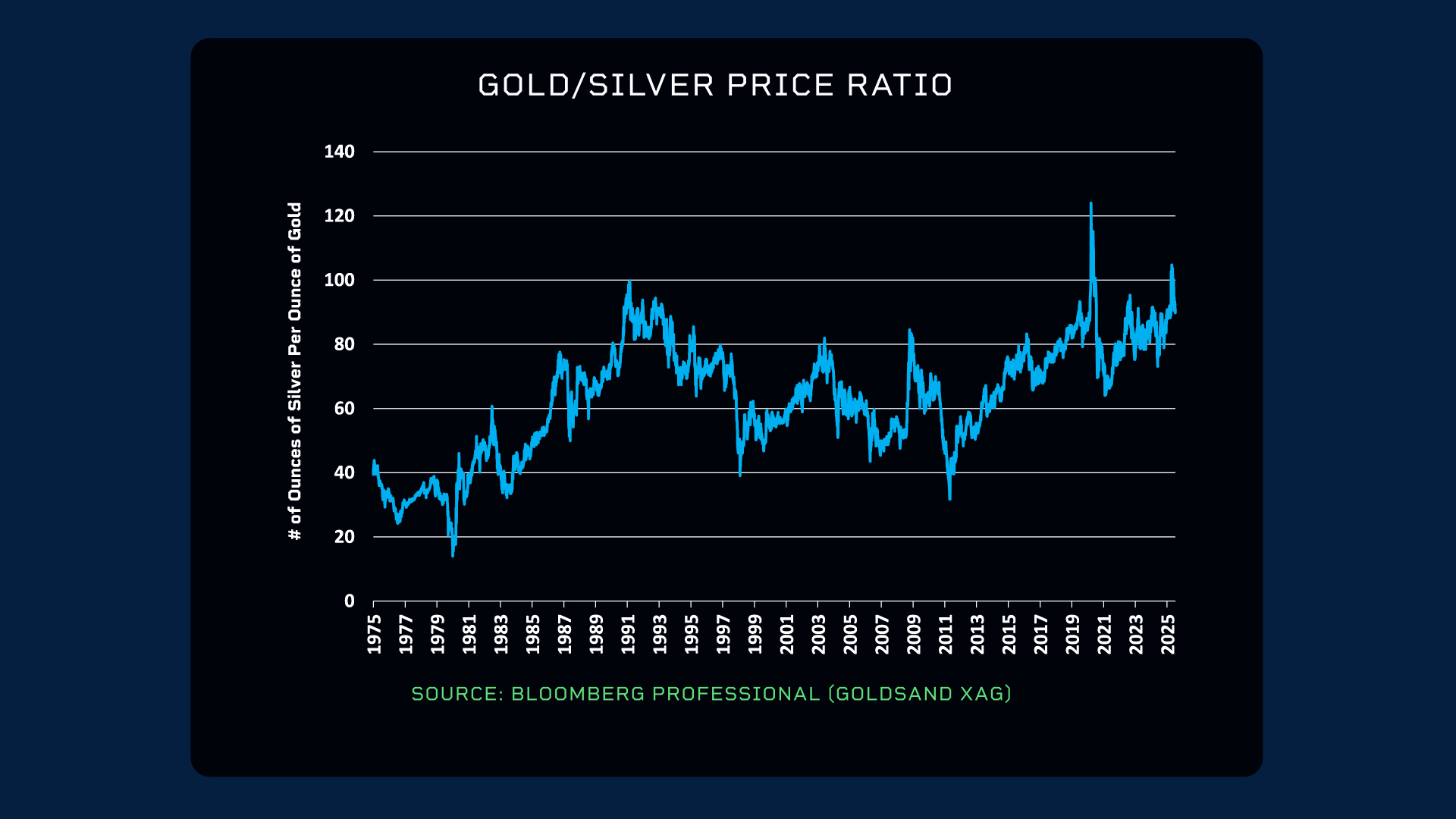

Back in 2011, it took 25 ounces of silver to buy an ounce of gold. Recently, the gold-to-silver ratio, which indicates how many ounces of silver it takes to buy a troy ounce of gold, crossed over 100 before coming back toward 90.

Factors Contributing to Silver's Underperformance

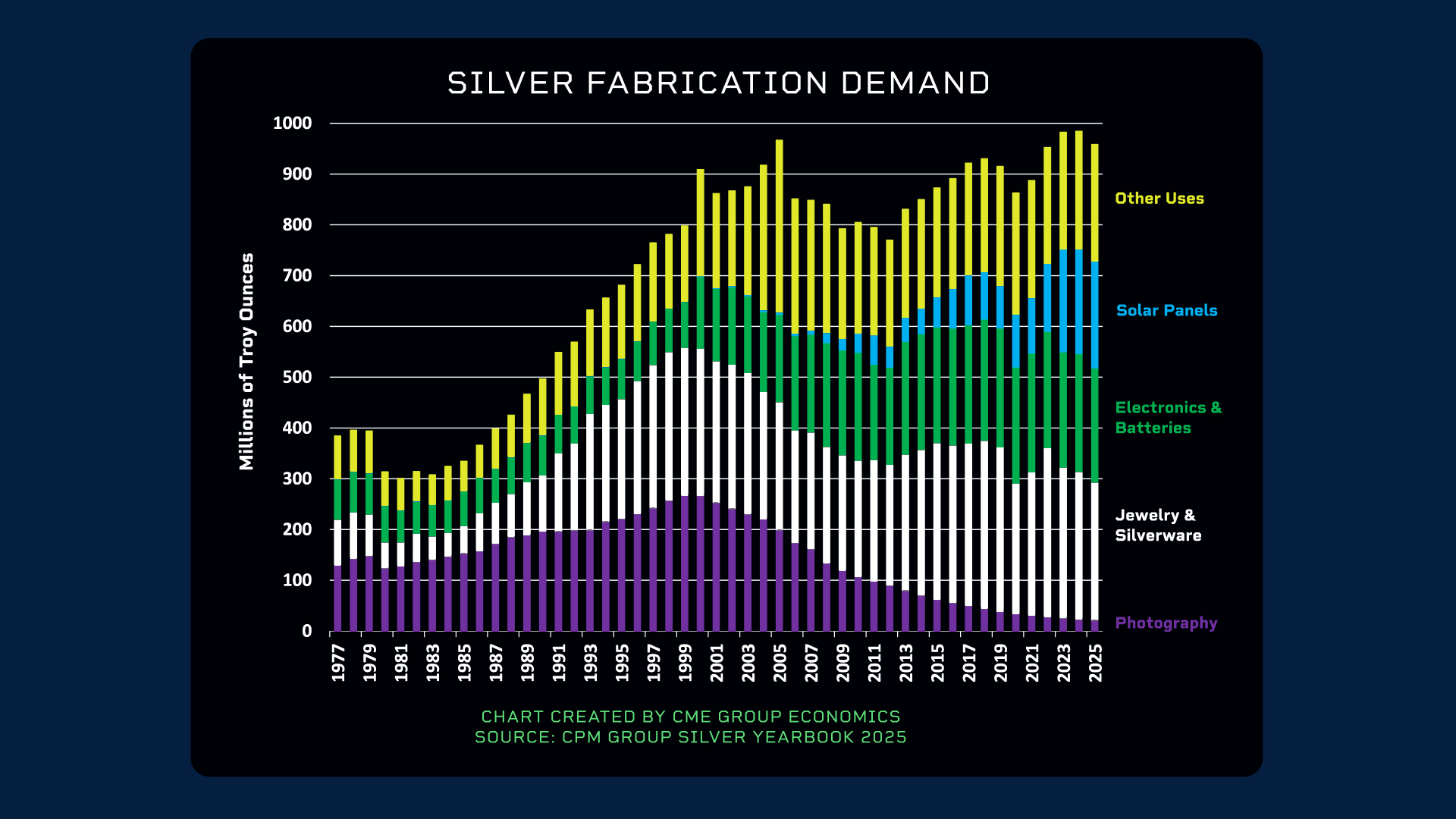

A primary driver of silver's historical underperformance is technological change. The widespread adoption of smartphones, for instance, significantly reduced the demand for photographic film, which historically relied on silver plates for development. In 2000, photographic applications accounted for approximately 25% of global silver consumption; this figure has since declined to approximately 3%.

Silver’s Rising Industrial Demand

Despite past challenges, new technological advancements could boost silver demand. Solar panel manufacturing, for example, now consumes roughly 16% of the world's silver supply, highlighting its critical role in renewable energy. Silver is also increasingly being utilized in battery technology, suggesting the energy transition could offset the demand previously lost in photography.

On the demand side, gold and silver are connected through the jewelry market. However, a key distinction lies in their industrial applications. Unlike gold, which has very few industrial uses, silver has a myriad of practical applications.

Read Erik Norland’s full research on the four major drives of the gold-silver price ratio.

Central Bank Influence

Gold possesses a unique advantage that silver lacks: central bank demand. Since 2008, central banks have consistently been net buyers of gold, a reversal from their prior role as net sellers. This sustained buying effectively removes gold from the market – at least until the central banks choose to reduce their holding – a trend unbroken since 2007.

Consequently, when excluding official central bank transactions, gold supply is actually lower today than it was in 2005, while silver supply has increased by over 35% during the same period.

Amid these evolving dynamics, silver still appears inexpensive relative to gold by historical standards.

CME Group futures are not suitable for all investors and involve the risk of loss. Full disclaimer. Copyright © 2025 CME Group I