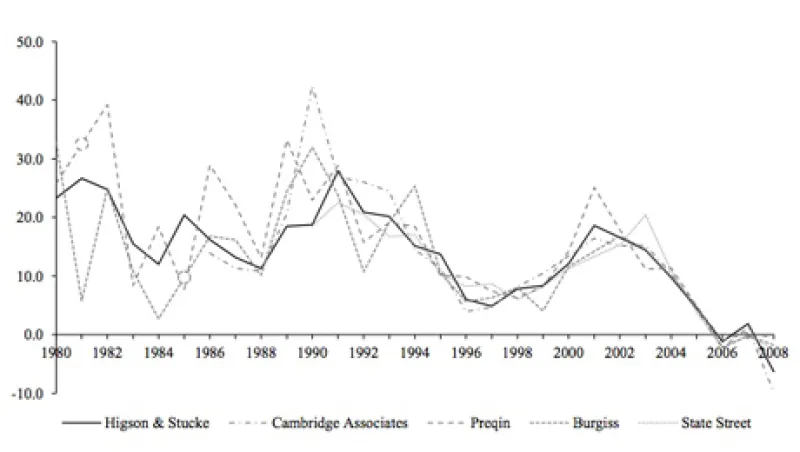

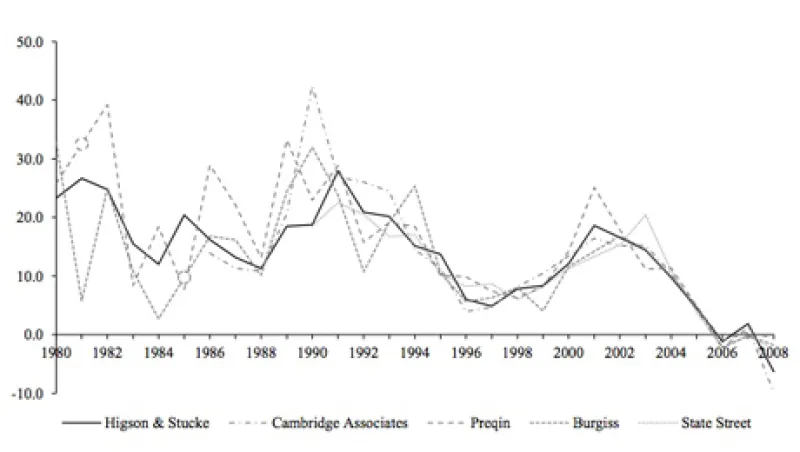

Research Shows PE Returns Are Legit. Sort Of.

If there were any remaining questions about the returns generated by the buyout industry, a new paper by Chris Higson and Rüdiger Stucke will put them to bed. But it's not all good news...

Ashby Monk

April 10, 2012