Brian Drainville, for Fidelity Investments

Key takeaways

- Market uncertainty amid tariffs, declining consumer sentiment, debt downgrades, and reduced interest coverage could present more distressed credit opportunities as capital structures that depend on low interest rates have shown some early warning signs of trouble.

- This may present opportunities for investments in the credits of stressed and distressed companies, especially organizations undergoing liability management exercises, a type of nontraditional restructuring that avoids bankruptcy.

- We offer five considerations for finding an active manager in this market niche.

Higher equity market volatility, wider corporate bond spreads, worsening consumer sentiment, and rising inflation expectations all have become concerns for investors as we near the start of the second quarter of 2025, amid government policy uncertainty and a growing global trade conflict.

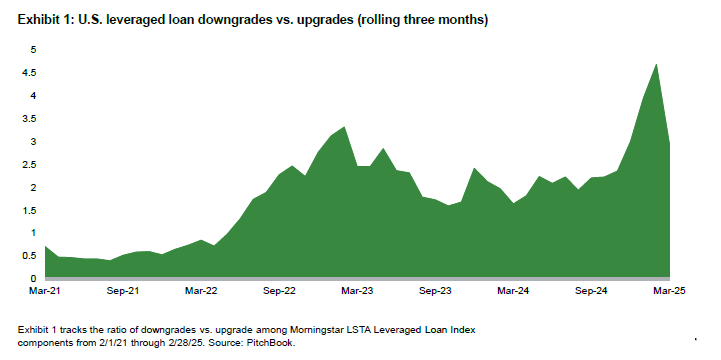

Meanwhile signs of early capital market stress have risen among companies with floating-rate capital structures. The number of downgrades vs. upgrades among components of the Morningstar LSTA Leveraged Loan Index stood at about 3 to 1 as of March 2025, up from about 1 to 1 this time two years ago (Exhibit 1). In conjunction, our team has seen an increasing number of companies with low interest expense coverage. This is due partly to rising interest rates since mid-2020, although more recent market concerns may be exacerbating this trend.

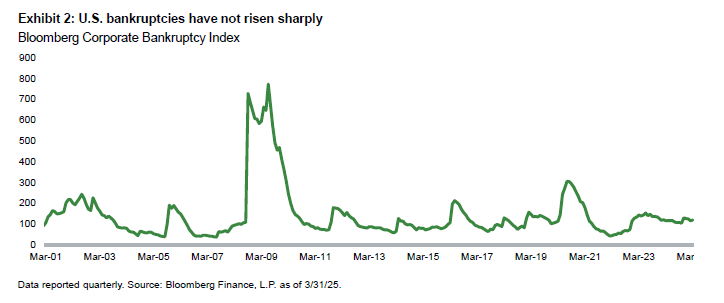

Various measures of capital market stress have increased slightly, although most have not broken their favorable long-term trends based on the latest available data. For example, the rate of bankruptcy cases in the U.S., measured by the Bloomberg Corporate Bankruptcy Index, has climbed since 2021, but as of March 2025, remained far below its recent peak in 2020 (Exhibit 2).

Each of these indicators mentioned bear watching, however. If higher-than-average market volatility and more consumer stress were to continue, history suggests they could exacerbate stressed debt (low credit ratings and elevated credit spreads) and distressed debt (securities trading at spreads above 10%).

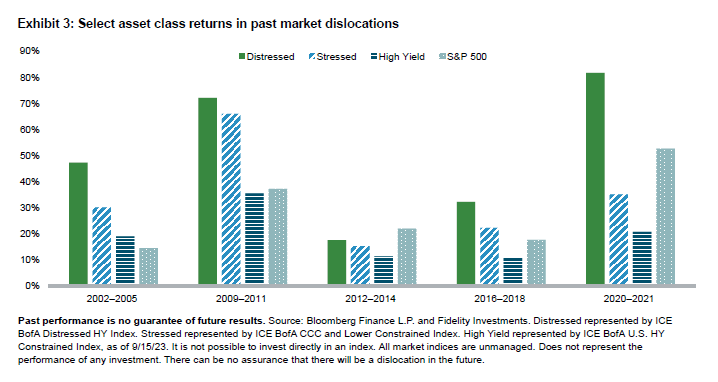

When this has happened in the past, it has presented opportunities for investments in the credits of stressed and distressed companies, which have shown low correlations with risk assets in times of market turmoil.

Exhibit 3 shows that distressed credit has delivered better returns than both the S&P 500 and high-yield bonds in four of the past five major equity market dislocations. Stressed credit outperformed high yield in four of the five dislocations.

As a reminder, the current state of the credit market is not distressed, according to the most recently available data. The delinquency rate for all business loans by commercial banks has risen only slightly as of Q4 2024, according to U.S. Federal Reserve and remains well off its peak during the Global Financial Crisis.

The rise of LMEs

That said, delinquencies don’t tell the whole story. This rate is likely suppressed by the number of companies undergoing liability management exercises (LME), a type of nontraditional restructuring that avoids bankruptcy and represents an increasing share of corporate defaults. These exercises often allow management teams to retain control of a company and continue to manage operations without the disruption and stigma that can accompany a court-overseen process. It typically involves restructuring debt obligations, buying back or exchanging debt, extending loan terms, or reducing interest rates.

LMEs are occurring with greater frequency partly because less-restrictive covenants have left loopholes for creative legal action. During periods of increased lending competition, creditors (particularly in the leveraged loan market) accepted reduced protection, which leaves more leeway for LMEs to take hold.

LMEs can take on a variety of different roles. Some examples include:

Consent solicitations that seek approval from bondholders for changes to existing debt terms.

Dropdown transactions that involve transferring assets, including intellectual property, to new subsidiaries outside of the claims of existing creditors to support new borrowing or to create new collateral.

Uptiering, which creates new debt with a higher priority in the capital structure or restructuring existing debt to provide certain creditors a higher priority claim.

It’s true that some LMEs have been disruptive to existing stakeholders, often pitting creditors against each other. More recently, however, there's been an increase in investors banding together under cooperation agreements, to both protect creditor standing and drive needed changes in companies' capital structures.

With the shifting paradigm comes elements of uncertainty, which can be beneficial to distressed investors. Active managers with significant resource capabilities can choose the credits and rank in the capital structure they believe are the most likely to result in advantageous terms.

Considerations for choosing a distressed investment manager

To be sure, engaging in these exercises is not for the uninitiated. Operating outside the structured court process requires coordination and connectivity. Following are what we believe are the five important characteristics that may improve the chances of success:

Size and scale: Managers with years of restructuring experience, as well as financial resources and connections within the advisor/restructuring/banking ecosystem, may be at an advantage when negotiating new terms.

Experience with LMEs: Liability management exercises have evolved into the modern way for companies to restructure their debt. But the concept of the LME itself is not new, so those with history and understanding of the intricacies of this market and how it differs from the traditional bankruptcy process can have an edge.

Deep research capabilities: Managers with the resources to analyze the fundamentals, finances and needs of many different businesses undergoing LME exercises can carefully select among those with a higher potential of capital appreciation.

Play an active role: We believe managers who can play an active role in leading other creditors, the companies, and advisors by creatively solving problems and reaching positive outcomes may be at an advantage.

Managing legal pitfalls: New LME lenders often receive favorable terms versus existing lenders.

In our view, understanding how to mitigate the potential for legal action by existing creditors when taking part in LME investments is critical and can help avoid costly mistakes.

Learn more about Fidelity’s Alternative Investment Strategies.

Listen in to the latest episode of Fidelity’s podcast series Alternative Angles.

To access more content, please visit Fidelity’s Communities on Alternative Investments.

Brian Drainville, CFA serves as a member of the investment management team, maintaining a deep knowledge of portfolio philosophy, process, and construction, assisting portfolio managers and their CIOs in ensuring portfolios are managed in accordance with client expectations, and contributing to investment thought leadership in support of the team. He is also a principal liaison for portfolio management to a broad range of current and prospective clients and internal partners, providing detailed portfolio reviews and serving as a key conduit of client objectives, requirements, and marketplace insight back to the investment team. He focuses on High Income and Asset Allocation products.

Information presented herein is for discussion and illustrative purposes only and is not a recommendation or an offer or a solicitation to buy or sell any securities. Views expressed are as of 3/31/25, based on the information available at that time, and may change based on market and other conditions. Unless otherwise noted, the opinions provided are those of the authors and not necessarily those of Fidelity Investments or its affiliates. Fidelity does not assume any duty to update any of the information. Unless otherwise noted, the opinions provided are those of the authors and not necessarily those of Fidelity Investments or its affiliates. Fidelity does not assume any duty to update any of the information.

Unless otherwise expressly disclosed to you in writing, the information provided in this material is for educational purposes only. Any viewpoints expressed by Fidelity are not intended to be used as a primary basis for your investment decisions and are based on facts and circumstances at the point in time they are made and are not particular to you. Accordingly, nothing in this material constitutes impartial investment advice or advice in a fiduciary capacity, as defined or under the Employee Retirement Income Security Act of 1974 or the Internal Revenue Code of 1986, both as amended. Fidelity and its representatives may have a conflict of interest in the products or services mentioned in this material because they have a financial interest in the products or services and may receive compensation, directly or indirectly, in connection with the management, distribution, and/or servicing of these products or services, including Fidelity funds, certain third-party funds and products, and certain investment services. Before making any investment decisions, you should take into account all of the particular facts and circumstances of your or your client’s individual situation and reach out to an investment professional, if applicable.

References to specific investment themes are for illustrative purposes only and should not be construed as recommendations or investment advice. Investment decisions should be based on an individual’s own goals, time horizon, and tolerance for risk.

This piece may contain assumptions that are “forward-looking statements,” which are based on certain assumptions of future events. Actual events are difficult to predict and may differ from those assumed. There can be no assurance that forward-looking statements will materialize or that actual returns or results will not be materially different from those described here.

Past performance is no guarantee of future results.

Investing involves risk, including risk of loss.

Diversification and asset allocation do not ensure a profit or guarantee against loss.

In general, the bond market is volatile, and fixed income securities carry interest rate risk. (As interest rates rise, bond prices usually fall, and vice versa. This effect is usually more pronounced for longer-term securities.) Fixed income securities also carry inflation risk, liquidity risk, call risk, and credit and default risks for both issuers and counterparties. Any fixed income security sold or redeemed prior to maturity may be subject to loss.

All indexes are unmanaged. You cannot invest directly in an index.

Index or benchmark performance presented in this document does not reflect the deduction of advisory fees, transaction charges, and other expenses, which would reduce performance.

Morningstar LSTA U.S. Leveraged Loan Index is a market-value weighted index designed to measure the performance of the US leveraged loan market.

ICE BofA Distressed HY Index tracks the performance of U.S. dollar-denominated, below investment-grade corporate debt, specifically those in a distressed or high-risk of default state, publicly issued in the U.S. domestic market.

ICE BofA CCC and Lower Constrained Index tracks the performance of U.S. dollar-denominated, below-investment-grade corporate debt, specifically those rated CCC1 and lower, while also capping issuer exposure at 2%.

ICE BofA U.S. High Yield Index tracks the performance of U.S. dollar-denominated, below-investment-grade corporate debt publicly issued in the U.S. domestic market.

Institutional Investor is an independent entity and is not affiliated with Fidelity Investments.

Fidelity Investments® provides investment products through Fidelity Distributors Company LLC; clearing, custody, or other brokerage services through National Financial Services LLC or Fidelity Brokerage Services LLC (Members NYSE, SIPC); and institutional advisory services through Fidelity Institutional Wealth Adviser LLC. Personal and workplace investment products are provided by Fidelity Brokerage Services LLC, Member NYSE, SIPC. Institutional asset management is provided by FIAM LLC and Fidelity Institutional Asset Management Trust Company.

1199293.3.0