A widespread industry practice is to create target date fund glide paths based on assumptions about a representative participant profile.1 Yet defined contribution plan demographics vary widely with respect to participant saving habits, income and outside retirement assets. Consequently, we don’t believe that a truly representative participant profile exists.

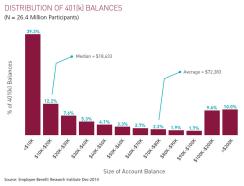

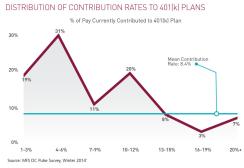

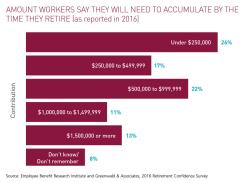

To illustrate the wide-ranging characteristics of defined contribution plan participants, we look at how much they have saved for retirement, how much they contribute to employer sponsored plans and how much they say they might need to sustain their lifestyle in retirement.

If an investment manager were to design a glide path for a representative participant based on the dimensions we have just highlighted, that glide path would be optimal only for one who contributes at an 8.4% rate, has approximately $72K in retirement savings and believes that he or she needs to accumulate roughly $650K by retirement. Clearly, such a profile represents a very small set of participants.

Thus designing a glide path based on a representative participant profile is rather like creating one average size shoe to fit an entire population. In most cases, it won’t be a good fit. Instead of focusing on a representative participant, we believe glide paths should be designed to suit most investors in a plan based on two key principles:

- Appropriately balancing capital appreciation and principal preservation objectives as a function of time to the target date

- Maximizing the sustainability of a participant’s retirement investments in the event of market shocks.

The views expressed are those of the author(s) and are subject to change at any time. These views are for informational purposes only and should not be relied upon as a recommendation to purchase any security or as a solicitation or investment advice from the Advisor. This content is directed at investment professionals only. 37637.2

More target date strategy advice from MFS experts at MFS.com/TDF.