Bob Iaccino, for CME Group

At a Glance:

- Gold is more than just an asset that moves opposite the dollar.

- Geopolitical tensions and central bank gold purchases supported gold, even as the dollar strengthened.

The relationship between gold and the U.S. dollar has historically been inverse - when the dollar strengthens, gold typically weakens, and vice versa.

This relationship is grounded in several fundamental market principles. As gold is priced in dollars globally, a stronger dollar means it takes fewer dollars to buy the same amount of gold. Additionally, gold becomes less attractive as a non-yielding asset when the dollar strengthens and U.S. interest rates rise, making dollar-denominated assets more appealing to investors seeking returns via yields.

However, in 2023 and 2024 we witnessed an unusual phenomenon: both gold and the dollar demonstrated significant strength simultaneously. Gold prices surged past $2,000 per ounce and set new all-time highs, while the U.S. Dollar Index (DXY) also showed remarkable resilience.

Why Gold and the Dollar Rose Together

Several factors contributed to this unconventional market behavior. First, geopolitical tensions, including the Russia-Ukraine conflict and Middle East instability, drove safe-haven demand for both gold and the dollar. In times of global uncertainty, investors often flock to these traditional safe harbors regardless of their typical correlation.

Second, central bank gold purchasing reached historic levels. China, Russia and several emerging market economies significantly increased their gold reserves to diversify away from dollar-denominated assets, providing steady support for gold prices despite dollar strength.

Third, despite the Federal Reserve's aggressive tightening cycle, persistent inflation concerns kept gold attractive as a traditional inflation hedge. While higher interest rates typically pressure gold, the market sentiment suggested inflation might remain sticky, sustaining gold's appeal.

The Inflation Hedge Theory

Gold functions effectively as an inflation hedge specifically when the Fed isn't actively combating inflation through rate hikes. This distinction explains why this abnormal relationship continued into early 2025.

Gold becomes particularly attractive when market participants anticipate rising inflation but expect the Fed to remain accommodative or even implement rate cuts. In this scenario, real interest rates (nominal rates minus inflation) trend lower, reducing the opportunity cost of holding non-yielding assets like gold.

Suppose the market anticipates inflation will persist while the Fed pivots toward monetary easing. In that case, we can observe the seemingly contradictory outcome of rising long-term yields (reflecting inflation expectations), driving dollar strength. At the same time, gold appreciates as investors seek protection against possible inflation-driven currency debasement. This dynamic perfectly describes market conditions in late 2023 and early 2024, as the Fed signaled its intention to cut rates while inflation remained above its 2% target.

Ongoing Uncertainty

Gold's role as a hedge against economic uncertainty and geopolitical risks remains prominent. Recent trade tensions – particularly between the U.S. and China – have driven increased demand for safe-haven assets. Notably, gold prices surged to $3,149.40 per ounce on April 10, 2025, following a dramatic rally earlier in the week. Gold prices then went on to set a record high on April 22. This reinforces the perception among institutional investors that gold is not merely a counter-dollar asset but a critical tool for risk diversification during periods of heightened uncertainty.

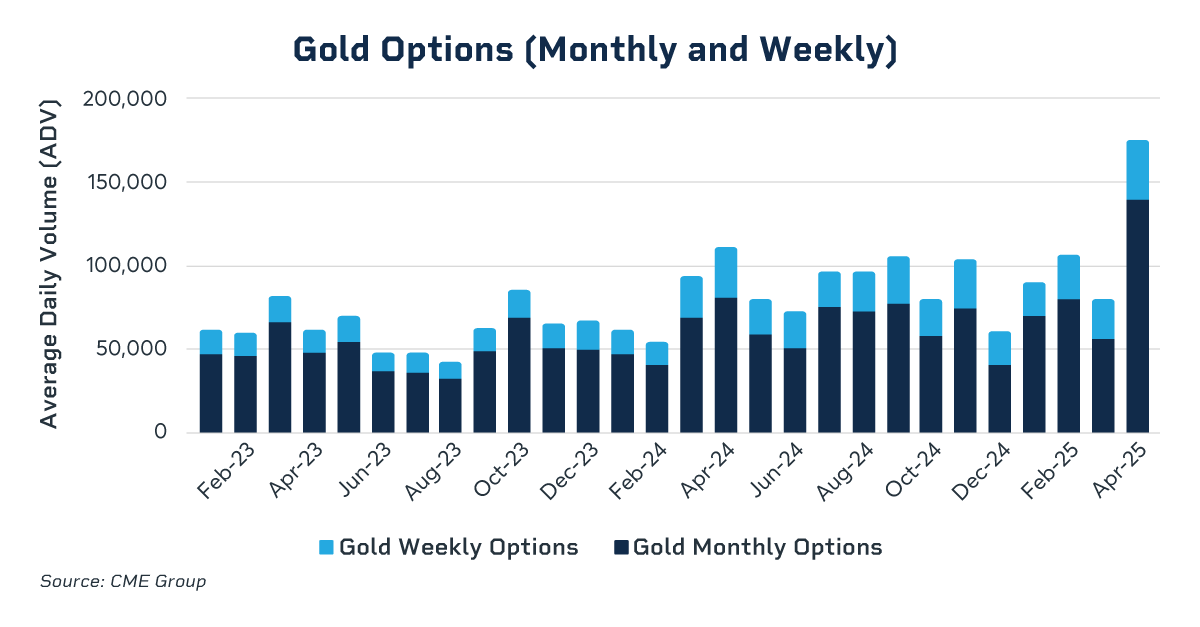

In April, gold options trading volumes reached record highs, with average daily volumes (ADV) exceeding 160k contracts. This surge was fueled by strong demand for both monthly Gold (OG) options and Weekly contracts, with Weekly contracts alone accounting for more than 35k contracts, making it the strongest month on record.

Is the Relationship Normalizing?

The traditional inverse relationship between gold and the U.S. dollar appears to reassert itself in certain market conditions. As the Federal Reserve transitions from its tightening cycle to potential easing, the mechanics driving both assets could realign more traditionally.

However, heightened global uncertainties, including ongoing trade disputes and geopolitical conflicts, can drive simultaneous demand for both gold and the dollar when they are both seen as safe-haven assets, potentially disrupting the historical inverse correlation between the two. Central banks continue to diversify away from dollar reserves, purchasing record amounts of gold, which reflects a structural shift that supports gold prices regardless of dollar movements.

Market analysts increasingly emphasize that gold's price is now more influenced by real interest rates, inflation concerns and systemic risks rather than solely by dollar strength. This evolving dynamic requires investors to adopt a nuanced approach, focusing on real interest rate trends, central bank policies and geopolitical developments when assessing gold's potential.

Overall, while some signs point to a partial normalization of the gold-dollar relationship, structural changes and global uncertainties suggest that this correlation could remain fluid, requiring investors to adapt their strategies accordingly.

CME Group futures are not suitable for all investors and involve the risk of loss. Full disclaimer.

Copyright © 2025 CME Group Inc.