By CME Group

At a Glance:

- The commodities market is experiencing an unprecedented level of activity, driven by both cyclical and structural forces.

- High trading volumes in short-dated and weekly options highlight the market's need for precise instruments to manage specific event risks.

The commodities market is not just experiencing a cyclical upswing; it's undergoing structural changes that are reshaping global trade, risk management and market participation. That's the core message from Derek Sammann, Senior Managing Director and Global Head of Commodities Markets at CME Group, who has seen sustained commodities growth driven by powerful underlying forces.

“2025 has been another record-breaking year for activity at CME Group, particularly on the commodity side, with a record of 5.8 million contracts traded on average daily. This is not isolated; we came off a record year across the entire commodities complex in 2024. This is a multi-year growth story,” Sammann noted in a recent interview.

While cyclical factors, such as weather patterns and short-term demand fluctuations, can influence prices, Sammann emphasized that today's market drivers are increasingly “structural in nature.” Amid these changes, a growing proportion of essential commodity products are now originating from the U.S., Sammann said. This fundamental shift underscores a growing need for benchmark commodity products.

The U.S. Is a Major Energy Exporter

One of the most significant structural forces within commodities is the internationalization of U.S.-based benchmarks, particularly in the energy sector.

“We believe that growing global benchmarks attract customers who want to be in the deepest, most liquid markets in the world,” Sammann explained. “Our WTI contract is the global benchmark for crude oil, and our Henry Hub natural gas benchmark is the global marker for the largest export market in the world – that’s what customers are drawn to.”

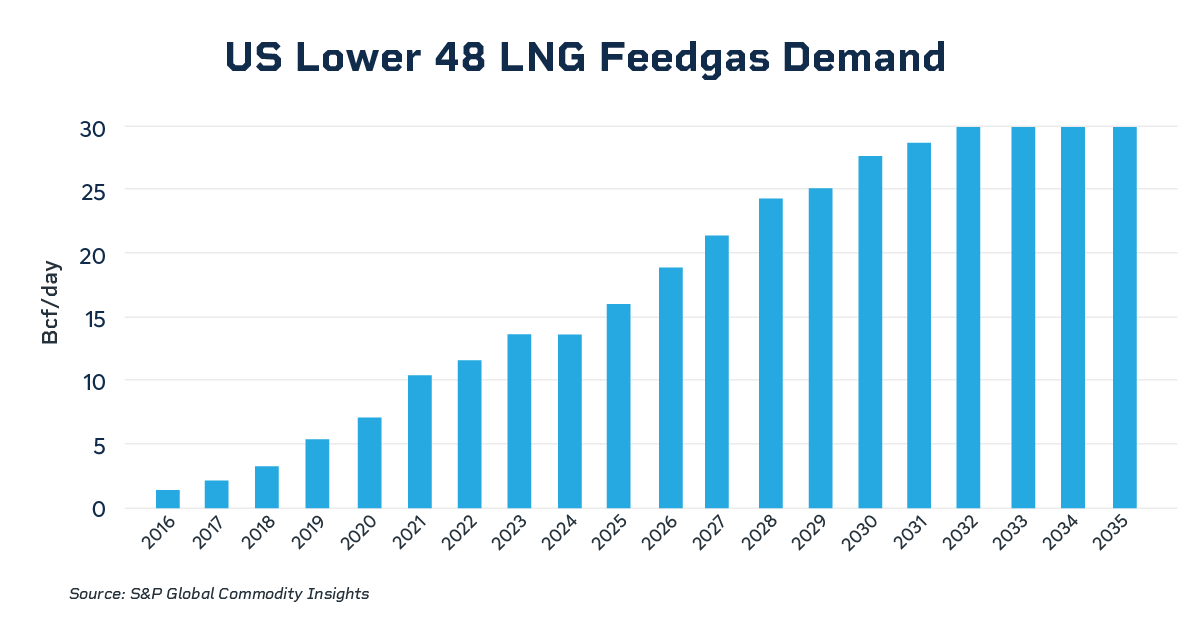

A key driver of this transformation is the U.S.’s ascent as a major exporter of both crude oil and natural gas, surpassing traditional leaders like Australia and Qatar. With record WTI crude and natural gas exports, and a projected near-doubling of Henry Hub LNG capacity by 2028, the U.S. is not merely filling a void created by geopolitical changes; it's laying a new foundation for global energy markets.

The shift has exposed a new generation of international buyers to U.S.-based crude oil and Henry Hub.

“We’re seeing a huge adoption of existing energy traders in Europe and Asia who are newly exposed to physical flows coming from the U.S. and that’s adding net new customers to our customer base – not only from a trading volume point of view but an open interest point of view as well,” Sammann said.

Furthermore, the role of natural gas has evolved from a seasonal commodity to a fundamental energy source. As Sammann explains, “the gas season has expanded to almost 12 months, as natural gas has become an input and a driver of energy creation in the U.S. and globally as well.”

This growth in non-seasonal demand across diverse sectors, including renewable energy, highlights its increasingly vital role beyond a mere transition fuel.

The Energy Transition's Wide Reach

Another major structural force reshaping the commodities landscape is the global energy transition. This transformation is not only establishing entirely new markets but also blurring the distinctions between existing ones.

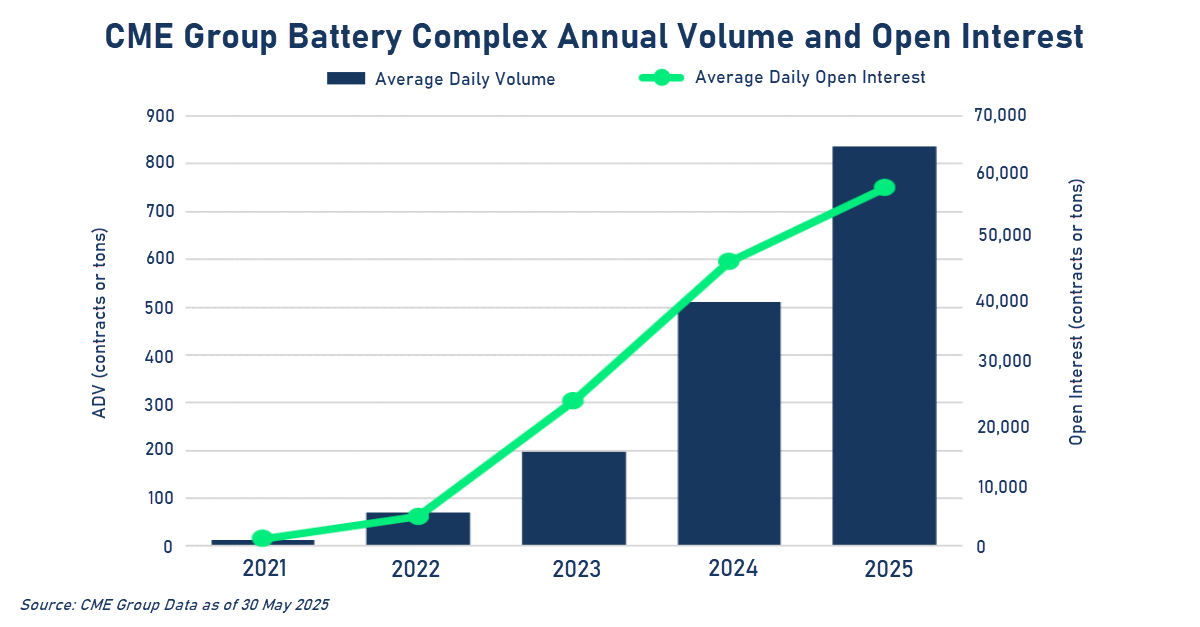

This trend is evident in the increasing demand for battery metals, fueled not only by electric vehicles (EVs), but also by a growing demand for plug-in hybrids and large-scale renewable energy storage.

CME Group's suite of battery metals contracts, including cobalt, lithium and spodumene, are seeing record volumes and open interest. This demonstrates the market's increasing reliance on CME Group as the leading exchange for hedging the evolving risks associated with these metals.

“Our product development has always been focused on what the end-user, the customer, needs and what unmet risk management tool we need to develop,” Sammann said, highlighting the exchange's responsiveness to this dynamic and evolving market.

CME Group’s battery metals suite includes Lithium Hydroxide futures and options, Lithium Carbonate futures, Cobalt Metal futures and options, Cobalt Hydroxide futures and Spodumene futures.

Agriculture: Is it Food – or Is it Fuel, Too?

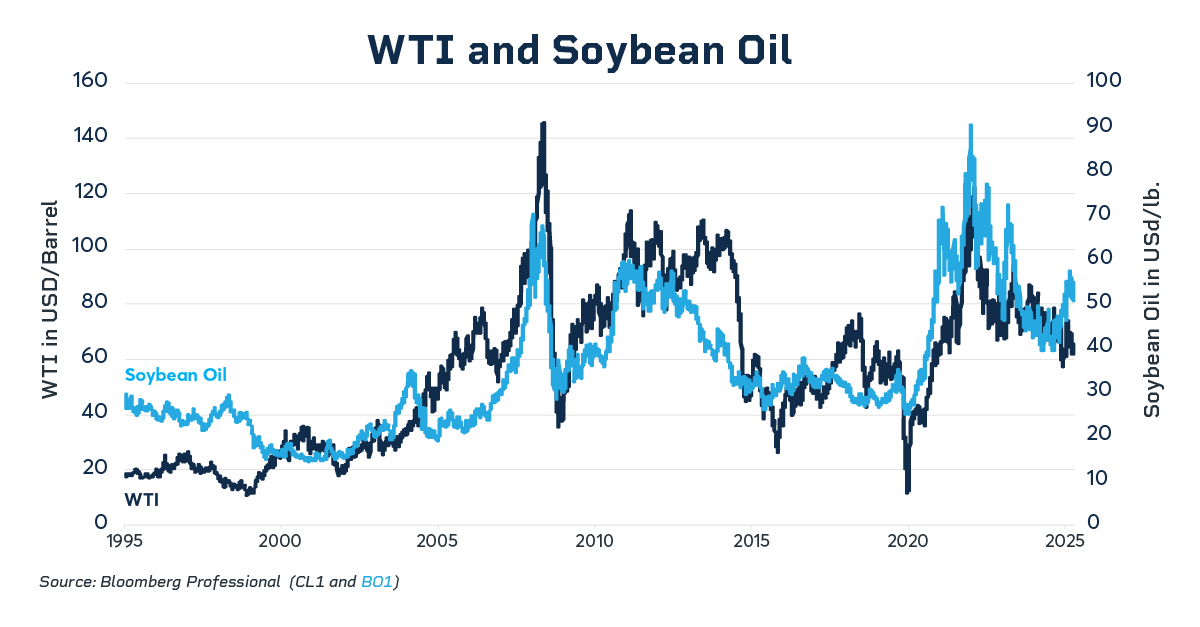

Even agriculture, traditionally cyclical, is experiencing structural changes linked to the energy transition.

“Soybean oil is basically the primary feedstock into renewable diesel, and so soybean oil is trading more like an energy product than an agricultural product,” Sammann explained.

This has led to increased correlations between soybean oil and energy contracts like RBOB gasoline or crude oil, attracting a broader range of participants, including energy firms, to the soybean market. “So we’re needing to rethink and reframe what is ags: Is it just food or is it fuel as well? And right now it's a little bit of both,” he said.

The Rise of Options

Within the evolving commodities landscape, options have become a crucial tool for managing risk, with trading volumes surging by 22% year-to-date. This trend is not just limited to one region; options markets in Europe and Asia have experienced “outsized growth,” as noted by Sammann.

The widespread appeal of options, which are available across all commodity asset classes, has driven significant activity. Record volumes in short-dated and weekly options highlight a market that is increasingly hungry for precise tools to hedge against specific event risks.

“Options are really purpose-built for a sophisticated hedger or speculator that is looking for more granular tools to hedge or get access to more discrete event risk,” Sammann said. From GDP numbers and trade reports to OPEC decisions or confirmations of deals done or not done, he added, "this market has risk in it every single day.”

The 2025 commodities boom stands as a testament to the structural changes reshaping global markets. Whether it is the increasing role of U.S. natural gas and crude oil exports, the expanding applications of battery metals or the evolving dynamics in agricultural markets, CME Group remains at the forefront, providing the tools and platforms for effective risk management.

CME Group futures are not suitable for all investors and involve the risk of loss. Full disclaimer. Copyright © 2025 CME Group Inc.