The investment management business is undergoing a dramatic and sustained shift, driven by technological advancements, higher client expectations, and firms’ mandates to control costs. Service providers are at the forefront of this transformation, introducing new solutions while enhancing existing products and platforms. Investment firms and their teams are now better equipped than ever to leverage technology and services to improve client relationships, investment decision-making, and overall business operations.

However, this advancement in technology and services comes with its own set of challenges. Meeting higher client expectations can put a squeeze on firms’ profitability, causing top management to also focus on controlling costs, both internal and external, forcing firms to make difficult decisions about which technologies to embrace and how they will impact investment and operating activities.

Against this backdrop, Institutional Investor’s Custom Research Lab and SS&C Advent have assessed how investment managers view the technology and services they use to manage their accounts, businesses, and regulatory mandates. We surveyed 150 decision-makers in investment and operating roles at North American institutions on their current and anticipated use of investment management technology. (Our complete findings are published in The Next Generation of Technology for Investment Management.)

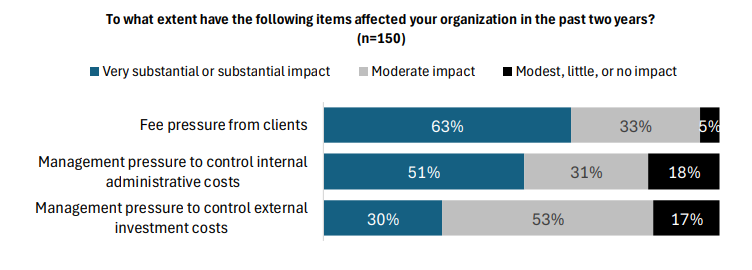

Asset and wealth managers are under sustained pressure from clients to limit management fees, according to study participants. Fully 63% of respondents reported that fee pressure from clients has had a substantial impact on their organization in recent years.

External and internal forces threaten management firms’ profitability

Pushback on investment fees is likely to be tied to growing sophistication of prosperous current and prospective clients, many of whom seek a do-it-yourself approach to investing using the broad array of low-cost investment products such as exchange-traded funds (ETFs) and model portfolios. Heightened competition, aggressive marketing from peer firms, and greater fee transparency may well contribute to clients holding the line on investment management fees as well. Price sensitivity among clients – even a few basis points – can have a material impact on firms’ topline revenue, professionals’ compensation, and, eventually, on client retention.

Study participants also voice concern about heightened cost consciousness among wealth management firms. A majority of respondents in the study say management pressure to control internal administrative costs has had a substantial impact at their firms in recent years, and 30% see such an impact from mandates to control external investment costs. One wealth manager interviewed for the report says, “Managing money is a labor-intensive business. We need access to data, high-quality research, brisk trading, and all the rest, but ultimately this is a business that requires a lot of thinking and hard work from people who can go elsewhere if our systems or compensation fall short.”

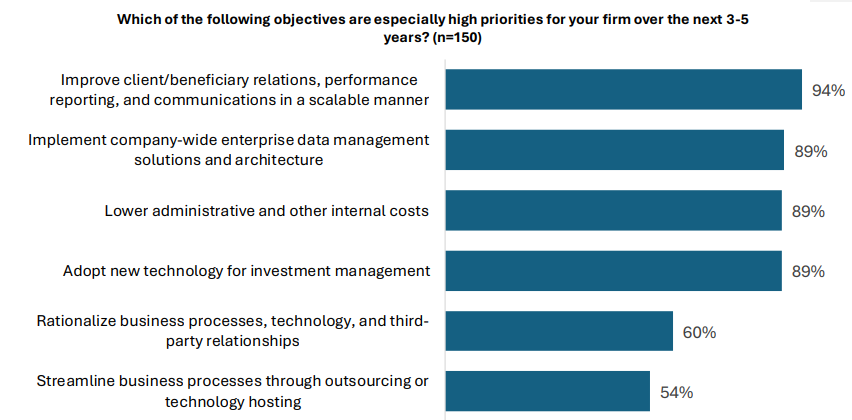

In response to topline pressure from clients and close cost oversight from firm management, a solid majority of survey respondents (94%) say they are poised to improve their relationships with clients by strengthening their performance reporting and client communication capabilities. Their efforts to do so are likely to call for investment in enterprise data management solutions and new technology for investment management, each of which are a high priority among 89% of study participants.

New technology lies at the heart of performance improvement

As they look to the future, investment management firms face the daunting task of finding, qualifying, and implementing technology solutions that will support their businesses effectively. Firms are likely to draw on teams from across their organization, with each team bringing their own unique priorities and biases to this important task. In many cases, firms are well positioned for such collaboration, as 64% of study participants say their investment teams and IT counterparts have a highly collaborative, rather than siloed professional relationship.

Similarly, respondents seem confident in their firms’ allocations of resources to IT projects, as 84% say funding and staffing for information technology are usually well understood and managed carefully. This finding is especially notable, say sources interviewed for this report: “As we prepared for acquisition and evaluated candidates,” says a principal at a wealth management firm, “we tried to be very thoughtful about how integration of our various systems would work. We wanted to ensure that we were teaming up with a firm that would share our values—not just for client service, but also for the way we want to work: with well-managed, ‘no-surprises’ systems changes.”

In the second article on the SS&C/II research collaboration, we’ll look at managers’ aspirations for technology and business changes, the strategies they’ll use to achieve them, and the barriers they’re likely to encounter as they adopt the next generation of technology for investment management.