By CME Group

At a Glance:

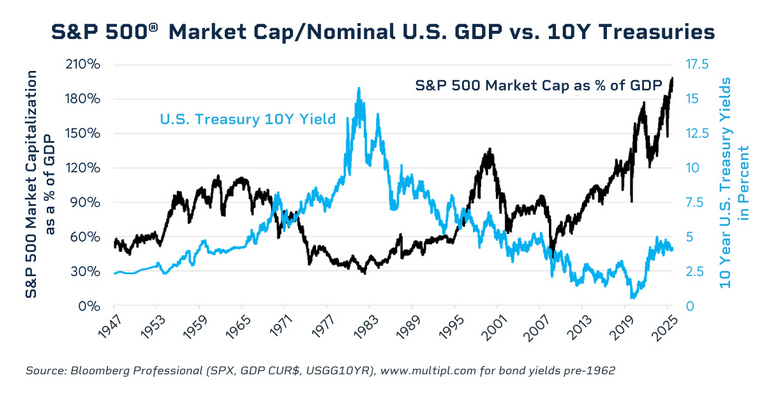

- Market concentration remains high, with the S&P 500's market capitalization at close to 200% of GDP – a historic peak.

- Fed rate cuts may offer initial market support, but their long-term impact depends on evolving economic conditions.

As markets navigate between optimism and caution, questions about valuations, central bank policy and economic sustainability remain at the forefront. For investors, understanding the tension between near-term momentum and fundamental risks is crucial for making informed decisions in any environment.

The Market Reality

The market rally of 2025, while impressive with the S&P 500 up approximately 18% by the end of last year, was notably concentrated for much of the year, although the rally did broaden out late in the year.

"This narrow leadership created a tension between the market's extraordinary upside momentum and fundamental indicators,” said Erik Norland, CME Group Chief Economist, in a recent video.

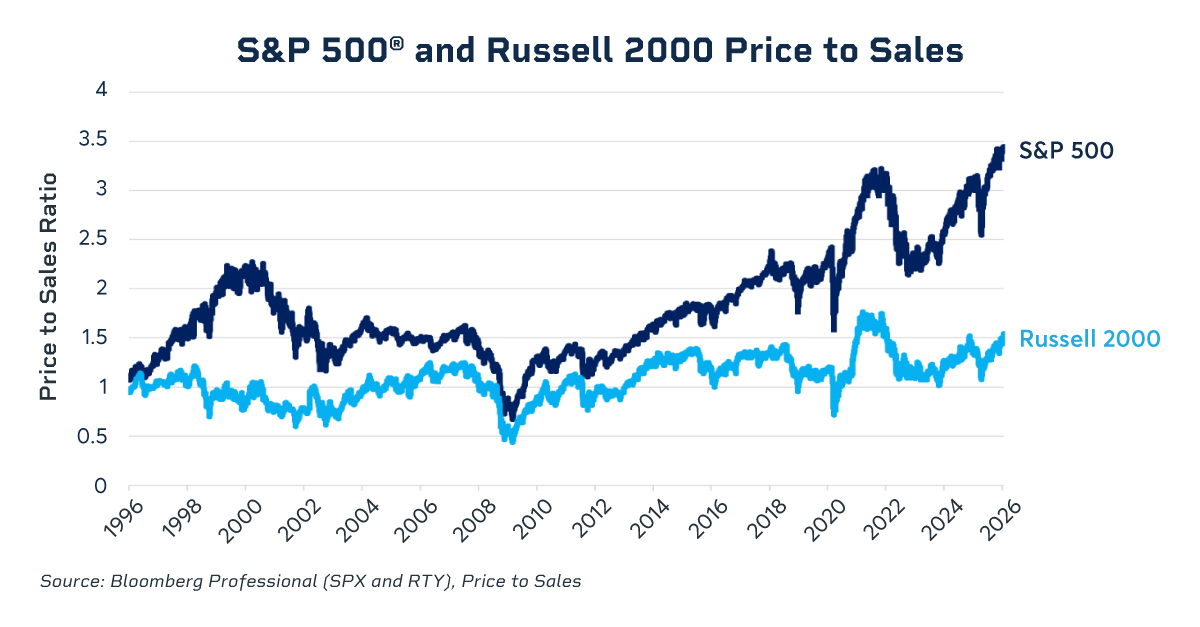

Corporate valuations – such as price-to-earnings, price-to-sales and price-to-book values – suggest that current levels are stretched. For instance, the S&P 500's trailing twelve-month P/E ratio is estimated at around 26 as of early January, which is higher than its long-run historical average of approximately 16.1.

History shows that periods of extreme market concentration, whether during the "Nifty Fifty" era of the 1970s or the dot-com boom of the early 2000s, typically precede a reversal.

"The most dangerous words in finance are, it’s different this time," said Cameron Dawson, CIO of NewEdge Wealth Investment. When the biggest weights in the market begin to underperform, overall market returns tend to suffer, she added.

The S&P 500 market cap currently stands at close to 200% of GDP – an unprecedented high.

"That would argue for an overvalued market that is maybe overextending," Norland said. However, he also offers a counterpoint: the Federal Reserve's actions, specifically cutting interest rates despite inflation running above target, could continue to fuel the rally. “It's a reminder that an overvalued market doesn't necessarily mean it can't climb higher,” he said.

The Fed’s Binary Rate Cut Scenario

The timing and context of the Federal Reserve’s rate cut decisions remain a significant variable for market direction this year. Dawson outlined two scenarios that could determine asset price performance:

- Cutting "because they can": "If the Fed is cutting because they can, meaning inflation has moderated and they want to stabilize the labor market, but it's not too weak, then markets can do well," Dawson explains. In this scenario, strong earnings and GDP estimates could continue to drive asset prices.

- Cutting "because they should": Conversely, "if the Fed is cutting because it should, meaning labor markets are in freefall…we don't think that equities would perform well in that environment," Dawson warns. Such a scenario would imply that current earnings estimates are too optimistic, potentially leading to downward revisions that would negate the benefit of rate cuts.

While history suggests equities initially trend higher after the first Fed rate cut, this trend is highly dependent on economic data. Higher inflation rates could change market expectations around anticipated rate cuts in the coming year. This could alarm long-term bond investors, potentially leading to rising yields at the 10- and 30-year points of the yield curve, which could ultimately "imperil the valuation of some of these technology companies," says Norland.

Risks Ahead

Beyond the Fed's actions and current stock valuations, two other macroeconomic risks underpin the current environment:

- Inflation's stubborn grip: A major concern for financial markets is the underlying assumption that inflation is definitively under control. "In almost every country in the world outside of Switzerland and China, inflation is running above target,” Norland said.

- The liquidity tightrope: The importance of the overall liquidity environment is another critical factor. Dawson highlights that the market has benefited from "an abundant liquidity environment," which has kept financial conditions easy despite relatively high Fed rates. However, she warns that "a tight liquidity environment could see valuations potentially come under more pressure."

Looking into 2026, it will be crucial to monitor factors like Treasury funding, the Fed's balance sheet and bond market volatility, as these could signal a shift in liquidity that impacts market valuations.

AI’s Broader Promise

Beyond these challenges, the promise of Artificial Intelligence (AI) offers a potential upside. While a widespread productivity boom driven by AI has yet to fully materialize, if it does, it could provide a powerful catalyst. If AI's benefits truly spread, "earnings estimates could continue to have more upside, which would be a key driver and key condition for this equity market to continue to rally," according to Dawson. This offers one fundamental justification for current, and potentially even higher, valuations.

The current market environment is balancing a concentrated rally and potentially stretched valuations against the tangible risks of persistent inflation and shifting liquidity. While the Fed's policy decisions will play a crucial role, the ultimate sustainability of this market may hinge on the broader effects of AI's benefits.

CME Group futures are not suitable for all investors and involve the risk of loss. Full disclaimer. Copyright © 2026 CME Group Inc.