Light Street Capital Management posted strong results last month, maintaining the momentum it has built over the past three years. The Tiger Cub headed by Glen Kacher reported a 4.52 percent gain in its long-short fund and a 3.82 percent return in its long-only fund, according to someone who has seen the results.

Last year, the hedge fund was up 37.3 percent after surging 45.7 percent and 59.4 percent in 2023 and 2024, respectively. The long-only fund picked up 25.7 percent in 2025.

Light Street reported its strong January results shortly after detailing in its January 26 fourth-quarter client letter, obtained by Institutional Investor, that it is “adjusting to a new area in technology investing.” It stresses that since its 2010 launch, four key themes — mobile, social, cloud computing, and e-commerce — drove rapid innovation and strong performance for its long positions and caused significant disruption for companies it shorted. Light Street acknowledges that over the past three years it has “discussed several iterations” of its playbook for “phased investing in AI.”

It asserts in the letter: “As the far-reaching implications of AI have continued to evolve, the formation of AI-driven economic opportunity is clearer to us than ever. AI as a supercycle is here to stay. As a result, we have redesigned our 15-year-old construct, implementing a new thematic framework that better aligns with the direction of the technology sector as we see it.”

Light Street is currently emphasizing five areas: infrastructure; cloud service platforms; data platforms; application and distribution; and automation, robotics, and space. “We believe these new categories are more closely aligned with the ongoing evolution of the technology sector and will help frame our portfolio construction for the decade to come,” Kacher explains in the letter.

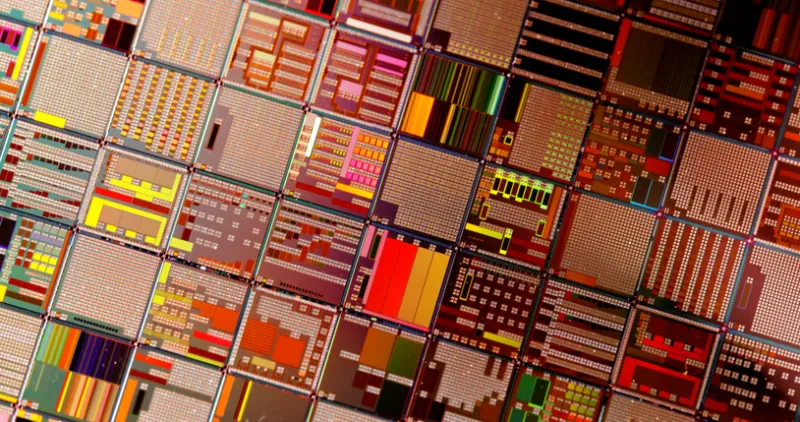

Of the five areas, infrastructure is by far the most important to Light Street right now, accounting for 50 percent of gross exposure and 80 percent of net exposure. It includes semiconductor and related capital equipment businesses, including chips, networking, optical, storage, and hardware systems.

“We expect semiconductor specialists to generate outperformance by identifying opportunities that remain underappreciated by generalist investors, while also running a robust short book to drive alpha and provide downside protection in an increasingly volatile market,” Kacher elaborates in the letter. “We do not expect this allocation to change in the near term.”

Major holdings include semiconductor giants Taiwan Semiconductor Manufacturing, a core holding for the past three years and the largest long position at the end of the third quarter; No. 2 long Nvidia; and No. 4 long Advanced Micro Devices, as well as semiconductor capital equipment makers ASML Holding and ASM International.

On the short side, one area where Light Street sees opportunity is makers of personal computers — especially notebook computers — and phone manufacturers being hurt by the sharp rise in costs for DRAM and flash memory. Light Street is targeting original design manufacturers in Taiwan, according to an investor.

The cloud service platform includes hyperscalers, neoclouds, and stand-alone AI foundation models — which build computing services for use by third parties, the letter explains.

Data platform includes infrastructure software such as data management platforms, developer tools, and cybersecurity software. “These are enterprise solutions that enable the creation and successful delivery of downstream applications,” Kacher notes in the letter.

Applications and distribution includes internet (e-commerce, social media, and entertainment), enterprise application software (horizontal and vertical), fintech, and mobile/AI device platforms. “These are both the end applications and the key channels for delivering those applications or services to both enterprises and consumers (e.g., Meta as a delivery platform for consumer AI to the masses),” the letter says.

Automation, robotics, and space includes autonomous cars, robots, and other next-generation technology systems that Light Street says bring AI into a physical form with reduced human intervention. “We believe these new categories are more closely aligned with the ongoing evolution of the technology sector and will help frame our portfolio construction for the decade to come,” the letter says.

“Looking forward, we see one of the most dynamic and rapidly evolving periods in the technology industry and broader global economy,” Kacher asserts. “We expect the coming years to bring similar levels of volatility and believe the advantage of a nimble, actively managed portfolio will continue to accrue to our benefit.”